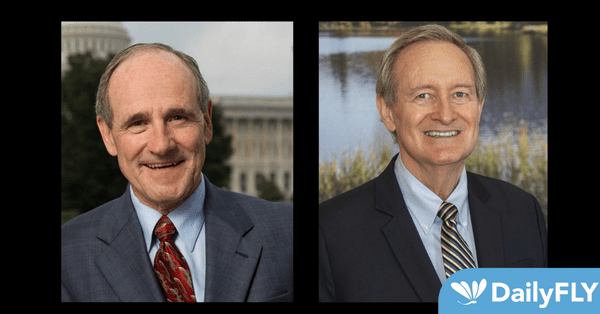

WASHINGTON, D.C.–U.S. Senate Finance Committee Ranking Member Mike Crapo (R-Idaho) and U.S. Senator Jim Risch (R-Idaho) joined Senator Tim Scott (R-South Carolina) on Friday to introduce the IRS Accountability and Taxpayer Protection Act to prohibit the Internal Revenue Service (IRS) from using penalties as a bargaining chip in reaching resolutions more favorable to the agency at the expense of hardworking Americans.

“With an additional $80 billion in IRS funding, $45 billion of which is reserved for enforcement, the IRS has new and unprecedented resources available to levy penalties against taxpayers,” said Senator Crapo. “Senator Scott’s sensible legislation is an important counter-balance that ends years of needless litigation by establishing something we need more of clear and simple tax rules. The most important part of this legislation is it is a taxpayer-favorable law that helps ensure the IRS will only impose penalties where appropriate and not as a bargaining chip. I look forward to working with my colleagues to create better ways to protect taxpayers and hold the IRS accountable.”

“The IRS has been a massive burden on the American people for decades, and under the Biden administration, it has expanded its size and empowered enforcement agents to bully Americans into settlements under the threat of financial penalties,” said Senator Risch. “To strengthen taxpayer protections amid growing threats from the IRS, Senators Tim Scott, Mike Crapo, and I introduced the IRS Accountability and Taxpayer Protection Act.”

Background:

Of the $80 billion in additional IRS funding appropriated by Congressional Democrats, approximately $45 billion is reserved for “enforcement.” With the IRS’s workforce growing by 45 percent by fiscal year 2025, American taxpayers need additional protections.

The IRS Accountability and Taxpayer Protection Act would strengthen essential taxpayer protection (IRC §6751(b)) by removing the language creating significant litigation and replacing it with a clear rule. This rule would require the IRS to verify penalties for accuracy rather than using them as a way to manipulate taxpayers to settle.

Americans for Tax Reform and the National Taxpayers Union endorse this legislation.

Full text of the IRS Accountability and Taxpayer Protection Act can be found here.