(The Center Square) – The S&P 500 had its worst year since 2008 and saw its third annual decline since 2018.

The blue-chip index closed out 2022 at 3,839.50, a 19.4% loss over the year, after closing 2021 at 4,766.18, representing 27% in gains. The reversal represents $8.2 trillion in losses, according to S&P Dow Jones Indices.

Nasdaq also reported 33.1% in losses, closing the year at 10,466.48.

The Dow Jones Industrial Average reported an 8.8% loss, closing the year at 33,147.25.

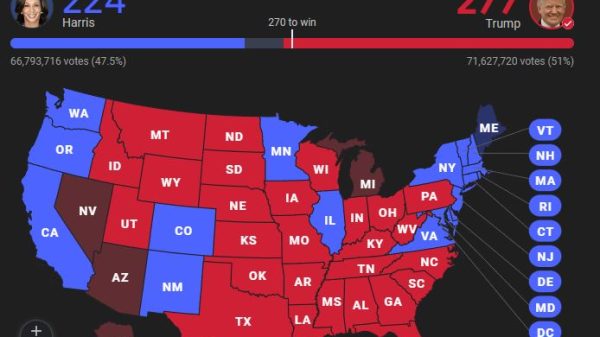

This is after President Joe Biden on January 7, 2022, said, “The stock market – the last guy’s measure of everything – is about 20% higher than it was when my predecessor was there. … It has hit record after record after record on my watch while making things more equitable for working-class people.”

The Dow Jones Media Titans index also reported record losses in 2022. The index, which tracks the performance of 30 of the largest media companies in the world, lost 40% of total market value, declining from $1.35 trillion to $808 billion, the Financial Times reported. This includes major Hollywood studios, cable streamers, and providers, among others that lost a combined $542 billion in market value in 2022.

As inflation continued to skyrocket, the Federal Reserve increased interest rates seven times throughout the year. Stocks struggled through a bear market, suffering prolonged price declines and an economic downturn that many economists argue is already turning into a recession.

At the beginning of 2022, interest rates set by the Fed were between zero and 0.25%. After seven increases, 2022 ended with a 4.25% to 4.5% base. Rates are expected to again increase this year to a base between 5% and 5.25%.

As interest rates increased, investors sold higher-costing tech shares. Companies like Amazon and Netflix lost about 50% of their market value resulting in Amazon laying off workers nationwide. Electric car manufacturing giant Tesla’s stock plummeted by 65% in 2022, roughly $700 billion in market value. Tesla also began laying off workers in 2022.

Meta Platforms, which owns Facebook, saw losses of 60%, its largest annual decline on record. Banks reported 14.5% in losses; telecommunications lost 11.2%.

The only gains posted among the S&P 500’s 11 sectors was the price of oil, which closed around $80 on Friday. Earlier in the year, it had reached $120, representing a gain of 59%.

Increased interest rates drove up consumer prices reflected in the Consumer Price Index, which increased month over month throughout the year. As a result, Americans were forced to make tough choices between purchasing food, and medicine, paying rent, mortgage or car payments, or canceling holidays. Small businesses also suffered.

This is after the stock market broke repeated record highs in 2019 under President Donald Trump, which held steady in 2020, and expanded through 2021. In Biden’s second year in office, the S&P500 closed 2021 up 27%, “marking its third year of double-digit gains,” Yahoo! Finance reported. “The Dow and Nasdaq wavered, but all indices were close to record highs.”

This year, worsening economic trends are forecast as rising inflation and interest rates are expected to retract consumer spending, negatively impact the housing and other markets and push the U.S. into a recession.