- Survey reveals how financial constraints are impacting weddings across America.

- Half said they would consider cutting food and rent in order to get married.

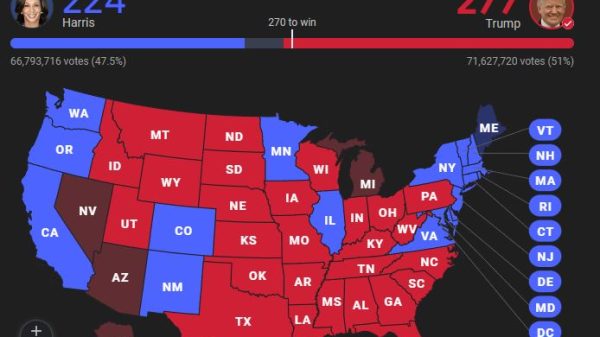

- Infographic showing the number of weddings impacted by state.

In a significant blow to the Idaho wedding industry, recent research conducted by BadCredit.org reveals that an estimated 3,388 couples in Idaho will not be tying the knot this summer due to poor credit. They surveyed more than 3,000 couples and discovered that many say they have been forced to postpone or cancel their wedding plans entirely due to financial constraints, particularly those stemming from inadequate credit scores.

Personal loans have traditionally been a popular method to finance weddings. However, couples with subprime credit often find themselves ineligible for such borrowing opportunities. Even those who aren’t reliant on loans grapple with other financial hardships that make the costs associated with weddings difficult to manage. With inflation and mounting costs adding to the pressures, many couples are reconsidering their options.

Map Showing The Number of Weddings Impacted by State

The study also unveiled significant regional disparities. For example, in Delaware, an estimated 4,444 weddings will not take place due to financial barriers. While this figure is lower than in many other states due to Delaware’s smaller population, couples here are the most disproportionately affected by financial constraints compared to other regions.

On the other hand, couples in Arkansas appear to rely less on credit to fund their weddings and are less affected by poor credit overall. However, the state is still projected to see 2,132 fewer weddings this season, according to the survey.

Couples Remain Hopeful…

Despite these challenges, many Idaho couples remain optimistic about the future. Among the survey respondents who said they had to postpone their nuptials this year, 61% said they hoped to get married in 2025, and 29% said they intend to wed within the next three years. Encouragingly, 40% of couples surveyed said the postponement had strengthened their relationships. However, 28% admitted that delays led to tensions, and 7% even reconsidered their relationships due to the financial strain.

When asked to choose between a lavish wedding with significant debt and a modest ceremony with financial stability, 88% opted for a modest wedding, preferring not to carry more debt into their married lives.

Nevertheless, some respondents revealed they would go to extreme lengths to fund their wedding: 54% of respondents would consider slashing essential expenses such as food and rent, 23% indicated they would sell personal or family heirlooms, and a less financially cautious 22% said they would take out a high-interest loan.

Despite the burdens that financial challenges can place on a relationship, love prevails for many couples in the survey. Nearly half (47%) of those who previously financed their weddings on borrowed money said they had no regrets in doing so.

“Ultimately, this research provides a sobering glimpse into how financial pressures impact modern relationships. The need to make prudent decisions amid these challenges is apparent, and the value of starting a marriage on sound financial footing has never been clearer,” said Jon McDonald, Senior Editor at BadCredit.org.